Car insurance in Tanzania is mandatory, with comprehensive coverage starting at 3.5% of a new car’s value and 4% for used cars. Third-Party Only (TPO) insurance, the legal minimum, costs around TZS 100,000 ($40) annually, while more extensive options like Third-Party Fire and Theft (TPFT) and comprehensive policies offer greater protection at higher premiums.

Key highlights for 2026:

- TIRA’s pricing rules: Ensure fair rates, with TPO as the basic legal requirement.

- Premium factors: Vehicle value, age, usage, and driver history impact costs.

- Digital tools: Apps and USSD codes simplify buying and managing insurance.

- Minimum rates: Comprehensive insurance starts at TZS 250,000 ($100) for lower-value cars.

Understanding your needs and comparing policies can help you choose the right coverage while staying compliant with Tanzanian law.

How Tanzania Regulates Car Insurance Pricing

Car insurance pricing in Tanzania is overseen by the Tanzania Insurance Regulatory Authority (TIRA). This authority operates under the Insurance Act No. 10 of 2009 and the Written Laws (Miscellaneous Amendments) Act 2017. These laws give TIRA’s Commissioner the power to establish premium guidelines and set limits on charges, ensuring consistency across the industry.

TIRA’s Minimum Rate Guidelines

To bring uniformity to the market, TIRA introduced "indicative rates" on July 1, 2018. These rates aim to standardize premiums and address inconsistencies in pricing. For comprehensive insurance, the guidelines specify that premiums for new vehicles should start at 3.5% of the vehicle’s value. For used vehicles, the rate is set at 4% of their depreciated value. If you come across premiums significantly lower than these rates, it could be a sign of non-compliance with TIRA’s regulations.

Required Third-Party Insurance vs. Full Coverage

By law, all drivers in Tanzania must have at least Third-Party Only (TPO) insurance. This basic coverage protects against damage or injury caused to other people, their vehicles, or their property. However, it does not cover any damage to your own vehicle.

For broader protection, drivers can opt for comprehensive insurance. This optional coverage includes everything TPO offers, plus protection for your own vehicle in cases of accidents, fire, or theft. An intermediate option, Third-Party Fire and Theft (TPFT), is also available. TPFT adds fire and theft coverage to the basic TPO policy, offering a middle ground between the two options.

sbb-itb-d9186c2

What Affects Your Car Insurance Premium

Several factors influence how much you pay for car insurance, and understanding them can help you manage costs while staying within TIRA’s guidelines. By knowing what affects your premium, you can make informed decisions to reduce your expenses without compromising coverage.

Vehicle Type, Age, and Usage

Your car’s type, age, and purpose significantly affect your insurance premium. Insurers calculate costs based on the car’s market value, adhering to TIRA’s minimum rates: 3.5% for new vehicles and 4% for used ones. For instance, a new car worth TZS 40,000,000 would cost TZS 1,400,000 annually, while insuring a used car valued at TZS 25,000,000 would require TZS 1,000,000.

Other factors, like the make, model, and engine size, also come into play. High-performance cars with larger engines typically cost more to insure due to higher repair costs and theft risks. On the other hand, fuel-efficient vehicles with easily available spare parts often come with lower premiums. If your car is used for commercial purposes – like taxis, delivery vans, or Bajaji three-wheelers – expect higher rates because these vehicles are on the road more often, increasing their exposure to risks.

Adding anti-theft devices such as GPS trackers, alarms, or immobilizers can help bring your premium down. These features lower the risk of theft and show insurers that you’re taking steps to protect your vehicle.

Driver Age, Experience, and Claims History

Your driving history plays a major role in determining your insurance costs. Insurers examine your claims history and accidents to assess your risk level. A clean record suggests you’re less likely to file claims, which translates to lower premiums. If you maintain a no-claims bonus, you could save up to 60% on your premium, depending on how many years you go without making a claim.

The rise of telematics and usage-based insurance in Tanzania is also changing how premiums are calculated. These systems use technology to track driving behavior, allowing insurers to adjust rates based on individual habits. Safe drivers who consistently demonstrate responsible driving can benefit from additional discounts.

Available Discounts and Premium Adjustments

Insurers often offer discounts and adjustments that can help lower your premium. For example, agreeing to a voluntary excess – the amount you pay out-of-pocket if you file a claim – can reduce your annual costs. This option is particularly beneficial for safe drivers who have savings set aside for emergencies.

Other ways to save include fleet discounts, which apply when you insure multiple vehicles under one policy, and policy bundling, where you combine car insurance with other types of coverage, like home or business insurance. Some insurers even provide extra perks, such as Britam’s full discounts on "Controller Technique" fees when you renew your policy.

Here’s a quick overview of some common premium adjustments:

| Adjustment Type | How It Works | Potential Benefit |

|---|---|---|

| No-Claims | Avoid filing claims for consecutive years | Up to 60% premium reduction |

| Voluntary Excess | Pay more out-of-pocket during claims | Lower annual premium |

| Security Devices | Install GPS trackers or alarms | Risk-based rate reduction |

| Fleet Discount | Insure multiple vehicles together | Reduced per-vehicle rate |

| Policy Bundling | Combine car with home/business insurance | Percentage discount on package |

Types of Car Insurance Coverage in Tanzania

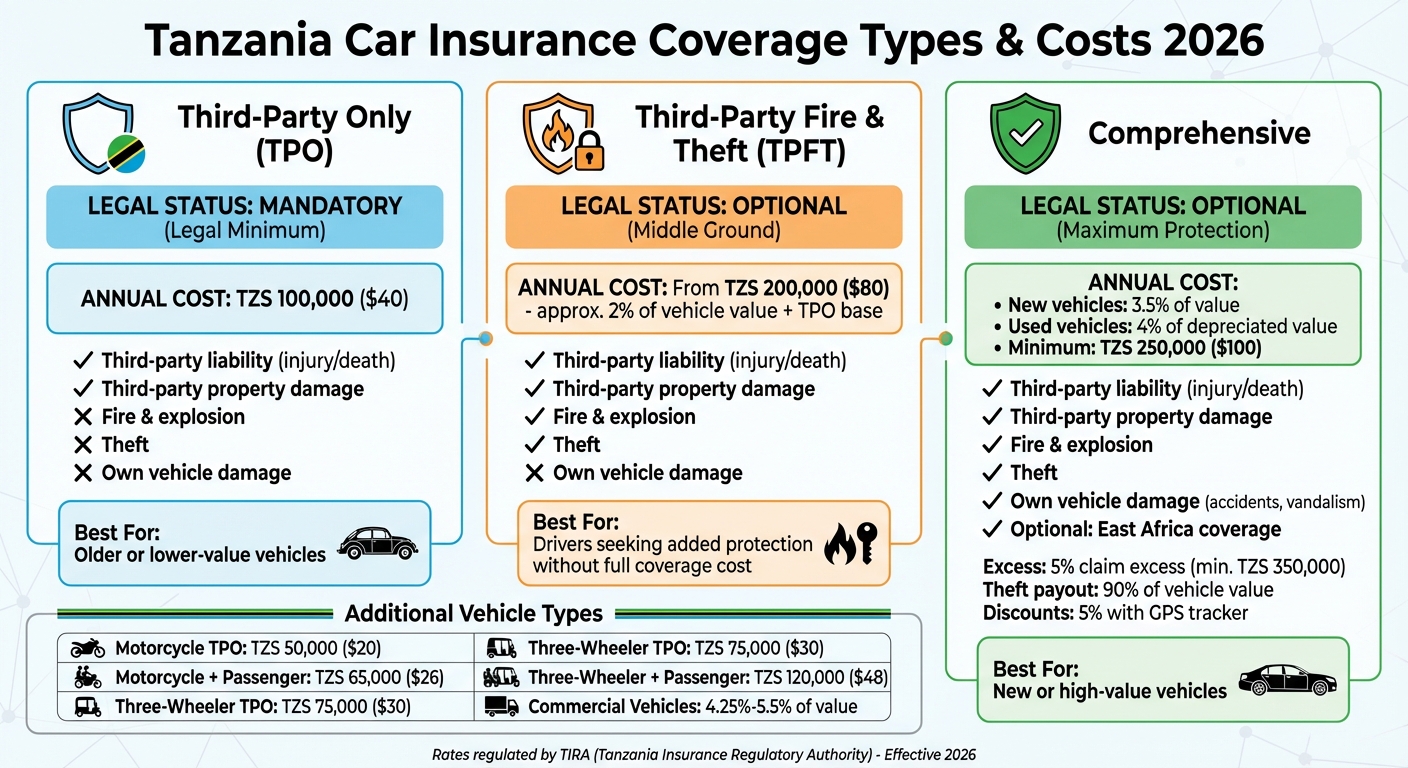

Tanzania Car Insurance Coverage Types and Costs Comparison 2026

When it comes to car insurance in Tanzania, there are three main types of coverage to consider. Each offers a different level of protection, so knowing what’s included can help you make an informed decision while staying within the law.

Third-Party Only Insurance

Third-Party Only (TPO) insurance is the minimum legal requirement for all vehicles in Tanzania. It covers you if you cause injury or death to others or damage their property or vehicles. However, it doesn’t cover any repairs or replacement costs for your own car. If your car is involved in an accident and needs significant repairs, you’ll have to pay those expenses yourself. TPO is a cost-effective option, particularly suitable for drivers with older or lower-value cars.

Third-Party Fire and Theft Insurance

Third-Party Fire and Theft (TPFT) insurance builds on TPO by also covering your vehicle against damage caused by fire, explosions, or theft. While it costs more than TPO, it’s still more affordable than comprehensive insurance. This makes it a practical middle ground for drivers looking for added protection without the higher expense of full coverage.

Comprehensive Insurance

Comprehensive insurance offers the most extensive protection. It includes third-party liability, coverage for fire and theft, and also covers damage to your own vehicle caused by accidents, overturning, vandalism, or malicious acts.

"The indicative minimum rate for comprehensive motor vehicle insurance cover will be 3.5 percent of its value, while for a used motor vehicle is four percent of its current value (after depreciation)." – Dr. Baghayo Saqware, Insurance Commissioner at TIRA

This type of insurance is highly recommended for new or high-value vehicles, as it safeguards your financial investment. Additionally, many comprehensive policies provide optional features, such as extended coverage for driving in neighboring East African countries. However, it’s important to note that most policies exclude incidents like drunk driving, using the vehicle without a valid license, and normal wear and tear.

| Coverage Type | Third-Party Liability | Fire & Explosion | Theft | Accidental Damage (Own Vehicle) |

|---|---|---|---|---|

| Third-Party Only (TPO) | Yes | No | No | No |

| Third-Party Fire & Theft | Yes | Yes | Yes | No |

| Comprehensive | Yes | Yes | Yes | Yes |

Up next, we’ll take a closer look at pricing examples for different types of vehicles in 2026.

2026 Car Insurance Price Examples

Understanding your insurance costs is a smart way to plan your finances. In Tanzania, the Insurance Regulatory Authority (TIRA) establishes minimum rates to keep premiums relatively standard across insurers. Here’s a breakdown of 2026 insurance pricing for various vehicle types.

Private Car Insurance Costs

If you’re opting for Third-Party Only (TPO) insurance, the price starts at around TZS 100,000 (about $40) annually. This is the most basic coverage, meeting legal requirements but offering no protection for your own vehicle.

For Third-Party Fire and Theft (TPFT) insurance, premiums typically begin at TZS 200,000 (roughly $80). This is calculated as around 2% of your car’s value, added to the TPO base rate.

Comprehensive insurance costs depend largely on your car’s value. If your vehicle is new or has a clean claims history, expect to pay about 3.5% of the car’s value. For used cars or those with prior claims, the rate increases to around 4% of the current depreciated value. For example, insuring a car worth TZS 20 million would cost approximately TZS 700,000 (about $280) annually. However, for lower-value cars, the minimum premium is TZS 250,000 (around $100).

Comprehensive policies come with a 5% claim excess, with a minimum of TZS 350,000 (about $140). In the event of a total loss due to theft, insurers typically pay out 90% of the car’s value after deducting a 10% excess. Adding a GPS tracker to your vehicle can lower your premium by about 5%.

Now, let’s take a closer look at insurance costs for commercial vehicles and motorcycles.

Commercial Vehicle and Motorcycle Insurance Costs

Commercial vehicles often carry higher premiums due to their increased risk. Comprehensive insurance rates for these vehicles range between 4.25% and 5.5% of the vehicle’s value, with a minimum excess starting at TZS 500,000 (about $200).

Motorcycle insurance, on the other hand, is more budget-friendly. TPO coverage for motorcycles starts at approximately TZS 50,000 (around $20) per year. If your motorcycle is used to carry passengers, you’ll need coverage that includes passenger liability, which costs about TZS 65,000 (roughly $26) annually. For three-wheelers, basic TPO coverage starts at TZS 75,000 (around $30), increasing to TZS 120,000 (about $48) if passenger liability is added.

| Vehicle Type | Third-Party Only | Comprehensive (Rate) |

|---|---|---|

| Private Car | TZS 100,000 ($40) | 3.5% – 4% of value (min. TZS 250,000 / $100) |

| Commercial Vehicle | Similar to private | 4.25% – 5.5% of value |

| Motorcycle | TZS 50,000 ($20) | Percentage-based |

| Motorcycle + Passenger | TZS 65,000 ($26) | Percentage-based |

| Three-Wheeler | TZS 75,000 ($30) | Percentage-based |

| Three-Wheeler + Passenger | TZS 120,000 ($48) | Percentage-based |

How to Buy Car Insurance in Tanzania

Buying from Local Insurance Companies

Getting car insurance in Tanzania is straightforward, with multiple options available. You can visit insurance providers like NIC, Jubilee, or Britam directly, or use bank branches that partner with insurers. For instance, Coop Bank and CRDB Bank offer motor insurance services through their networks, a model known as Bancassurance.

Some car dealerships also provide tailored insurance policies that come with perks like replacement vehicles during repairs or waiving excess charges for accidents. Additionally, NIC has introduced the "NIC Kitaa" campaign in cities like Iringa, bringing insurance services directly to local markets, so you don’t always need to visit an office.

It’s always a good idea to compare quotes and coverage limits before settling on a policy. Once you’ve explored these traditional options, consider digital solutions that make the process even more convenient.

Using Mobile Apps and Digital Services

Digital platforms have revolutionized how people buy car insurance in Tanzania. For example, T-PESA offers a service called "Bima na T-PESA", accessible by dialing _150_71#. With this service, you can instantly purchase insurance by entering your vehicle registration number, Taxpayer Identification Number (TIN), and confirming payment via your mobile money PIN. Partners like Jubilee Insurance issue cover notes immediately after payment.

CRDB’s SimBanking app allows you to buy and manage motor insurance straight from your phone. NIC’s "Kiganjani" app goes a step further, letting you monitor claim progress and access daily insurance tips. Even if you don’t have a smartphone, USSD codes like _150_71# work on basic phones, making these services widely accessible.

Before starting your digital application, make sure you have your vehicle registration number and TIN ready. Additionally, if your car has a GPS tracking device, mention it during the purchase process – you could qualify for a 5% discount on your premium. These tools not only simplify buying insurance but also make filing claims faster and easier.

Filing Claims & Receiving Support

If you’re in an accident, your first steps should be ensuring safety, checking for injuries, and contacting the police to file a report. This report is a key document for submitting your claim. Take photos of the accident scene and notify your insurer as soon as possible.

Claims can be filed through various methods. You can visit your insurer’s branch, use mobile apps like NIC Kiganjani or CRDB’s SimBanking, or initiate the process through T-PESA’s USSD menu. Typically, you’ll need to provide documents such as a completed claim form, a police abstract, a copy of your driver’s license, and an assessment report or garage quotation. For total loss or theft claims, additional items like the original logbook, transfer forms, car keys, and your original insurance certificate are required.

Some insurers, like Absa Tanzania, simplify the process by handling documentation and claims on your behalf. Many providers also offer toll-free support lines and 24/7 online reporting through their websites. Keep in mind, however, that you may need to pay a policy excess – an upfront amount – before your insurer covers the rest of the costs.

The shift toward digital tools has streamlined not just purchasing insurance but also managing claims, making it easier to navigate Tanzania’s car insurance market efficiently.

What’s Changing in Tanzania’s Car Insurance Market

Recent developments in regulations and efforts to make insurance more accessible are reshaping the car insurance landscape in Tanzania. These changes are set to influence both pricing and availability for drivers across the country.

New Regulations and Tax Adjustments

Starting July 1, 2025, new tax policies introduced under the Finance Act 2025 are expected to affect insurance costs. A 10% withholding tax on insurance and reinsurance services has been implemented, while reinsurance premiums are now exempt from VAT. Additionally, the VAT rate for business-to-consumer transactions has been lowered, which could help stabilize or even reduce premiums for individual car owners.

Another noteworthy change is the introduction of excise duties on carbon emissions. This could indirectly raise costs for high-emission vehicles, as overall ownership expenses increase. At the same time, the Tanzania Insurance Regulatory Authority (TIRA) is introducing Risk-Based Capital Adequacy guidelines and stricter governance measures to enhance market stability.

Expanding Access to Insurance

TIRA has set an ambitious goal: by 2028-2029, 50% of adults in Tanzania should have access to at least one insurance product, a significant leap from the current 15%. To achieve this, insurers are forming strategic partnerships to extend their reach. For instance, in January 2026, NIC entered a three-year partnership with Coop Bank Tanzania, allowing the bank to distribute NIC’s insurance products across its entire branch network. This Bancassurance model is gaining traction, with other institutions like CRDB Bank also offering motor insurance to broaden accessibility.

These efforts, combined with earlier digital and regulatory advancements, are paving the way for a more stable and inclusive car insurance market in Tanzania.

Conclusion

In Tanzania, car insurance isn’t optional – it’s a legal requirement. The Tanzania Insurance Regulatory Authority (TIRA) has set minimum rates to ensure fair pricing and maintain the financial stability of insurers: 3.5% for new vehicles and 4% for used vehicles. For private vehicles, basic Third-Party Only coverage begins at TZS 118,000 in 2026.

Choosing the right insurance plan – whether it’s Third-Party Only, Third-Party Fire and Theft, or Comprehensive coverage – depends on your vehicle’s value and your personal risk tolerance. While Comprehensive policies provide the highest level of protection, basic third-party coverage is a cost-effective way to meet legal requirements for older, lower-value cars.

There are also smart ways to reduce your premiums. For example, installing a tracking device, agreeing to a higher voluntary excess, and maintaining a clean claims history can all help lower costs. On top of that, digital tools are making the insurance process more transparent, and bancassurance partnerships are simplifying how policies are purchased and claims are handled. These advancements are key to achieving TIRA’s ambitious goal of expanding insurance coverage to 50% of adult Tanzanians, up from the current 15%.

With this changing landscape, it’s more important than ever to make informed decisions. Take the time to compare quotes, research insurers’ claim handling reputations, and choose coverage that aligns with both your legal obligations and financial needs. Thanks to stronger oversight and the rise of digital tools, Tanzanian drivers now have access to more transparent and diverse insurance options than ever before.

FAQs

How does TIRA ensure car insurance prices remain fair in Tanzania?

The Tanzania Insurance Regulatory Authority (TIRA) plays a key role in ensuring that car insurance pricing remains fair and transparent. By regulating and overseeing insurance providers, TIRA works to maintain a stable market while protecting consumers. They handle licensing for insurers and enforce compliance with mandatory indicative premium rates, ensuring that everyone operates within a set framework.

These measures are designed to prevent unfair pricing practices, giving drivers in Tanzania access to clear and reasonable insurance options that align with their needs.

What can I do to lower my car insurance costs in Tanzania?

Reducing your car insurance premium in Tanzania can be achieved with a few practical steps. One option is to go for third-party coverage instead of a comprehensive plan. This type of insurance meets the legal minimum requirements and typically costs less. You can also consider selecting a higher deductible – the portion you pay out-of-pocket before your insurance steps in. While this lowers your premium, make sure you’re financially ready to cover that deductible if needed.

Insurance providers often offer discounts for simple actions like signing up online, opting for paperless billing, or setting up automatic payments. Bundling your policies – such as combining car insurance with home or property coverage – can also lead to noticeable savings. Additionally, maintaining a clean driving record and participating in safe-driving programs can show insurers that you’re a low-risk driver, which may qualify you for further discounts.

Other ways to cut costs include installing anti-theft devices, parking your car in secure locations, and keeping your annual mileage low. These measures reduce the risk for insurers, which can translate into lower premiums. Combining several of these strategies is often the best way to maximize your savings.

How have digital tools made it easier to buy car insurance in Tanzania?

Digital tools have reshaped how people in Tanzania buy car insurance, making the process quicker and more convenient. Now, with just a few details about your car, you can receive tailored quotes within seconds, compare various coverage options, and choose the policy that suits you – all from the comfort of your home.

Many insurance providers have introduced online platforms that handle the entire process digitally. These platforms let you pick from different coverage types, such as third-party, fire-theft, or comprehensive, and even complete your payment online. Whether you prefer using mobile money or a credit card, integrated payment systems make it easy to finalize your purchase without dealing with physical forms or office visits. This digital approach not only saves time but also minimizes errors and gives you immediate access to your policy documents.

From basic coverage to more comprehensive plans, these tools simplify finding and securing the right car insurance to meet your specific requirements.

Related Blog Posts

- How to insure your car in Tanzania

- Comprehensive car insurance in Tanzania: Everything you need to know in 2025

- What’s the real cost of comprehensive car insurance in Tanzania?

- How to Get the Best Car Insurance Deal in Tanzania