Importing a car into Tanzania involves strict rules, multiple taxes, and specific documentation. Here’s what you need to know:

- Age Limit: Vehicles must be no older than 8 years. Older cars incur an extra 20% excise duty.

- Right-Hand Drive: Only right-hand drive vehicles are allowed, except for certain exemptions like construction machinery.

- Pre-Shipment Inspection: Mandatory inspections ensure safety and emissions compliance. Without a Certificate of Conformity, your car may be rejected.

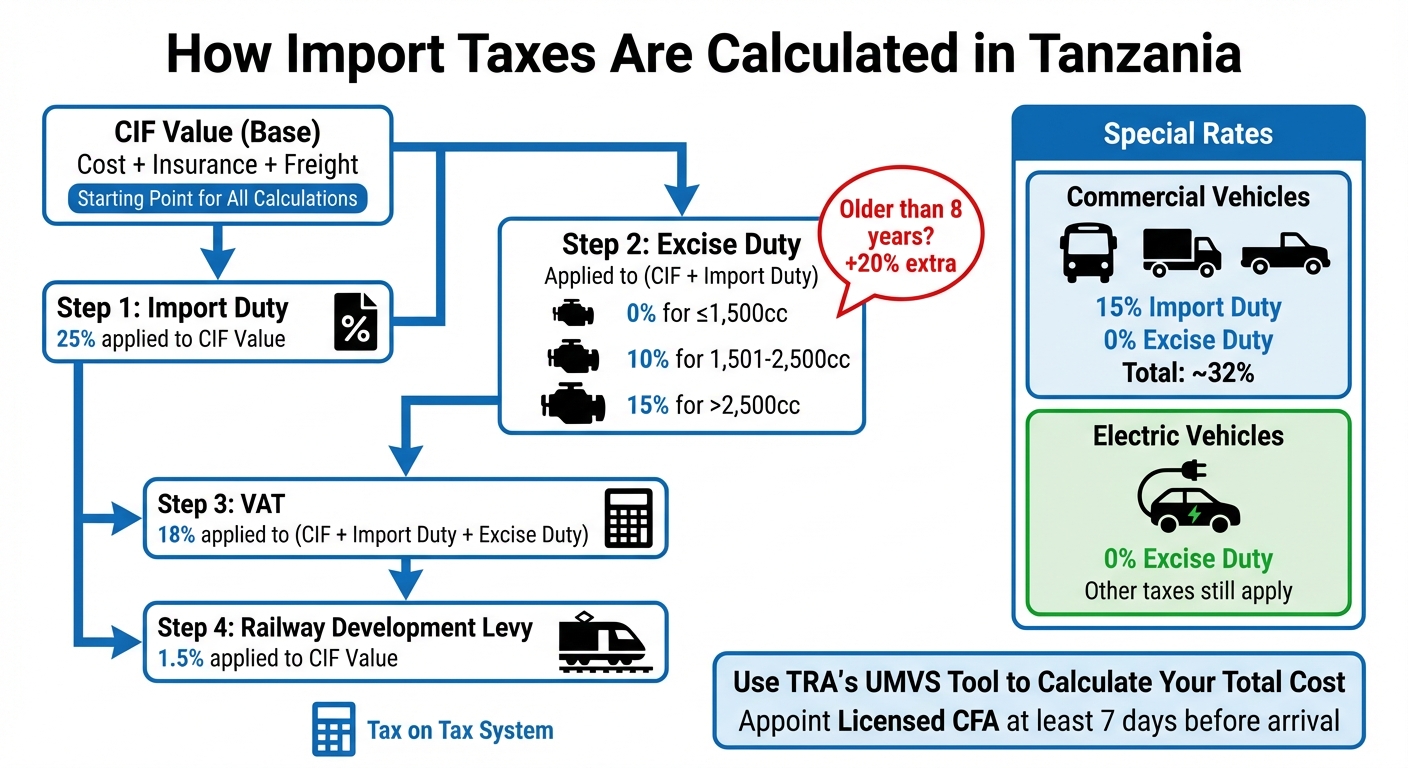

- Taxes and Duties: Expect a 25% import duty, 18% VAT, 1.5% Railway Development Levy, and excise duties (0–15% based on engine size).

- Electric Vehicle Incentives: Electric cars enjoy 0% excise duty, but other taxes still apply.

- Required Documents: Key documents include a Bill of Lading, Import Declaration Form, inspection certificate, and export certificate.

- Clearing Process: Licensed Clearing and Forwarding Agents handle the Tanzania Customs Integrated System (TANCIS). Submit documents at least 7 days before the vehicle arrives.

- Cost Planning: Use the Tanzania Revenue Authority‘s valuation tools to estimate total costs upfront.

Quick Tip: Missing any requirement can lead to delays, penalties, or vehicle rejection. Work with a licensed agent to avoid issues.

Importing Cars to Tanzania? Pre-Shipment Inspection Rules Explained!

Tanzania’s Car Import Regulations

Tanzania has a structured set of rules for importing vehicles, aimed at ensuring road safety and protecting the local automotive market from low-quality imports. Here’s a breakdown of the three key requirements every importer must follow.

The 8-Year Age Limit Rule

Tanzania permits the import of vehicles that are up to 8 years old from their manufacturing date. However, if the vehicle exceeds this age, an additional 20% excise duty is applied on top of the standard import charges. This "age tax" can significantly increase the total cost, often making older vehicles more expensive than newer ones after all fees are factored in.

This rule isn’t an outright ban but serves as a deterrent against bringing in older vehicles. To avoid surprises, always verify the manufacturing date before purchasing and shipping a car. You can use the Tanzania Revenue Authority’s Used Motor Vehicle Valuation System to estimate the full tax liability in advance.

Right-Hand Drive Requirement

Since Tanzania follows a left-hand traffic system, all imported vehicles must be right-hand drive (RHD). This rule is strictly enforced, and left-hand drive vehicles are not allowed unless they fall under specific exemptions, such as construction machinery or diplomatic vehicles. Always check the vehicle’s drive orientation before making a purchase to ensure compliance.

Emission and Safety Standards

Every vehicle must undergo a mandatory pre-shipment inspection to ensure it complies with safety and emission standards. Agencies like JEVIC (Japan Export Vehicle Inspection Center), QISJ (Quality Inspection Services Japan), or JAAI conduct these inspections. They verify that the vehicle is roadworthy and meets emission requirements.

Skipping this inspection can lead to serious consequences, including hefty fines or rejection of the vehicle upon arrival at the Port of Dar es Salaam. To avoid these issues, schedule the inspection before shipping. The cost of the inspection is far less than the penalties for non-compliance.

Import Taxes and Duties

Tanzania Car Import Tax Breakdown and Cost Calculator

The tax structure plays a crucial role in determining your overall import costs. In Tanzania, the Tanzania Revenue Authority (TRA) oversees all international trade taxes and employs a "tax on tax" approach to calculate total duties.

Here’s how the calculations work:

- CIF Value as the Starting Point: The CIF value (Cost, Insurance, and Freight) includes the vehicle’s purchase price, shipping fees, and insurance. This value forms the basis for all tax calculations.

- Import Duty: A 25% Import Duty is applied to the CIF value.

- Excise Duty: This is calculated on the combined total of the CIF value and Import Duty. Rates depend on engine capacity:

- 0% for engines up to 1,500cc

- 10% for engines between 1,501cc and 2,500cc

- 15% for engines above 2,500cc

- VAT: A Value Added Tax (VAT) of 18% is then applied to the total of the CIF value, Import Duty, and Excise Duty.

- Railway Development Levy: An additional 1.5% levy is charged on the CIF value.

For vehicles older than 8 years, there’s an extra 20% excise duty, as explained in the 8-Year Age Limit Rule section. On the other hand, commercial vehicles like buses, lorries, and pickups enjoy reduced rates – 15% Import Duty and no Excise Duty – bringing their total tax burden to about 32%.

To estimate your total costs, use the TRA’s UMVVS tool with your vehicle’s details. It’s also essential to appoint a Licensed Clearing and Forwarding Agent (CFA) at least 7 days before your vehicle’s arrival to handle documentation through TANCIS. These steps can help you plan your investment with greater precision.

Pre-Shipment Inspection Process

Before your vehicle can be shipped, it must undergo a mandatory Pre-shipment Verification of Conformity (PVoC) to comply with TBS safety and environmental standards. Without a valid Certificate of Conformity (CoC), you risk facing penalties or even rejection.

For Japanese vehicles, the inspection process shifted from a Destination Inspection to a mandatory pre-shipment verification starting July 20, 2022. This change introduced stricter checks, which are detailed below.

JEVIC Inspection Requirements

The Japan Export Vehicle Inspection Center (JEVIC) is one of the key agencies authorized to conduct these inspections, alongside the Japan Automobile Appraisal Institute (JAAI) and Quality Inspection Services Japan (QISJ). These organizations ensure your vehicle’s roadworthiness through thorough checks, examining areas like the engine bay, exhaust system, suspension, instrumentation, and overall structural integrity.

Inspectors also assess the vehicle for issues such as chassis corrosion, fluid leaks, and faulty safety equipment (e.g., lights, mirrors, wipers). Additionally, they evaluate whether the vehicle meets emission standards. If your vehicle fails any part of the inspection, it must be repaired and re-inspected before it can be shipped.

Inspection Fees and Required Documents

The JEVIC inspection fee is approximately ¥25,000 per vehicle. To complete the process, you’ll need to provide an Export Certificate from Japan, a Proforma/Commercial Invoice with purchase details, and an Agent’s Authorization Letter if you’re using a clearing agent. Once the vehicle passes inspection, JEVIC will issue a Certificate of Conformity, which is a critical document for customs clearance in Tanzania.

Work closely with your Licensed Clearing and Forwarding Agent (CFA) to submit all inspection documents through the Tanzania Customs Integrated System (TANCIS) at least seven days before your vessel arrives. Timely submission through TANCIS ensures a smoother process, aligning with the customs clearance steps that follow.

sbb-itb-d9186c2

Required Documents for Customs Clearance

To clear Tanzanian customs, you’ll need to submit a complete document set through the Tanzania Customs Integrated System (TANCIS). This system is strict – any incomplete declarations are automatically rejected by its Integrated Query System (IQS). Your Customs Forwarding Agent (CFA) will handle the TANCIS submission, but it’s important to familiarize yourself with the required documents. Here’s a breakdown to help ensure a smooth customs clearance process.

Bill of Lading

The Bill of Lading (BoL) is your official proof of shipment and vehicle ownership. This document, issued by the shipping line, is essential for obtaining a Delivery Order once your vehicle arrives at the port. The exporter will send the original BoL, along with the logbook and inspection certificate, via courier. Without these originals, you won’t be able to claim your vehicle.

Import Declaration Form (IDF)

The Import Declaration Form (IDF) notifies customs about your imported goods and calculates your tax liability. Your CFA will prepare and submit this form through TANCIS. The fee for the IDF is calculated by multiplying the Free on Board (FOB) price by 1.12, then adding $10 per vehicle. Make sure this form is lodged at least seven days before your vehicle’s arrival. Once processed, you’ll receive a Tanzania Single Administrative Document (TANSAD), which is a key part of the clearance process.

Additional Supporting Documents

In addition to the BoL and IDF, you’ll need to provide the following documents:

- Final/Commercial Invoice – Confirms the purchase price for customs valuation.

- Inspection Certificate – Verifies that the vehicle meets safety and emission standards (issued by JEVIC, QISJ, or JAAI).

- Export Certificate – Documents such as a UK Logbook or Japanese Export Certificate to confirm proper de-registration in the country of origin.

- MOT Test Certificate – Required for UK vehicles over three years old to prove roadworthiness.

- Agent’s Authorization Letter – Grants formal authorization to your CFA to act on your behalf.

- Taxpayer Identification Number (TIN) – A mandatory requirement for the customs clearance process.

Tax Benefits for Electric and Hybrid Vehicles

Starting from the 2023/2024 fiscal year, Tanzania has introduced a 0% excise duty rate for electric vehicles. This means if you’re importing an electric four-wheeler (E4W) or an electric bus, you can skip the excise duty entirely – a noticeable financial advantage compared to traditional fuel-powered vehicles, which previously faced excise duties ranging from 0% to 44%.

However, other taxes still apply. These include a 25% import duty, 18% VAT on the vehicle’s CIF value, and a 1.5% Railway Development Levy. Combined with the higher upfront cost of electric vehicles, these taxes can significantly increase the total expense. Researchers Gabriel Clement Malima and Francis Moyo noted that for electric cars to achieve cost parity with internal combustion engine (ICE) vehicles, "the current import taxes have to be reduced by 40% or more, which is equivalent to removing all import duty or value-added taxes".

While electric vehicles clearly benefit from tax incentives, hybrids face more uncertainty. Hybrids with engines under 1,500cc fall into the 0% excise duty bracket. However, Tanzania’s recent policies don’t explicitly exempt hybrids from excise duty in the way neighboring Uganda does. To avoid surprises, it’s a good idea to verify your hybrid’s classification with your Customs Forwarding Agent using the Tanzania Revenue Authority’s Motor Vehicle Valuation System.

It’s not just the vehicle purchase that impacts costs – spare parts and batteries can also add up. Currently, there’s no confirmation that replacement components for electric vehicles qualify for the same tax breaks as the vehicles themselves. This means you should plan for standard import duties on batteries and other EV-specific parts unless your clearing agent advises otherwise. Additionally, some vehicle categories, like e-bicycles and e-tuk-tuks, don’t have specific Harmonised System (HS) Codes, which can lead to inconsistent customs classifications.

On the bright side, electric two-wheelers already compete well with fuel-powered motorcycles in Tanzania in terms of cost. If you’re looking for a more budget-friendly option, importing an electric motorcycle or scooter might provide better immediate value compared to a passenger car.

Conclusion

Bringing a car into Tanzania requires careful planning and strict compliance with local rules. For starters, vehicles must meet the 8-year age limit; older models face a 20% excise duty penalty. Additionally, only right-hand drive vehicles are allowed, and pre-shipment inspections are mandatory to obtain a Certificate of Conformity. These regulations are critical to managing both the process and associated costs.

When budgeting, take into account the 25% import duty, 18% VAT, a 1.5% Railway Development Levy, and excise duties ranging from 0% to 15%. To avoid surprises, use the Tanzania Revenue Authority’s Used Motor Vehicle Valuation System (UMVVS) to estimate your expenses before committing to a purchase. Early financial preparation is key to avoiding unexpected costs.

It’s also essential to work with a Licensed Clearing and Forwarding Agent (CFA). They’ll handle the required documentation through the TANCIS system, which must be filed at least 7 days before the vehicle’s arrival. Keep in mind that incomplete submissions are automatically rejected, leading to delays and extra expenses.

If you’re importing an electric or hybrid vehicle, double-check its tax classification with your CFA to avoid any surprise charges.

FAQs

Can I import a car into Tanzania if it’s older than 8 years?

Yes, importing a car older than 8 years into Tanzania is allowed, but it comes with extra expenses. These vehicles are subject to an additional excise duty: 25% for non-utility vehicles and 5% for utility vehicles, which is charged on top of the usual taxes and fees.

It’s also worth noting that older cars might need to pass more rigorous inspections and could face other penalties. Make sure to account for these added costs when deciding if bringing in an older vehicle is the right choice.

What steps should I take to ensure my car meets Tanzania’s pre-shipment inspection requirements?

To make sure your car meets Tanzania’s pre-shipment inspection rules, here’s what you need to do:

- Check if your vehicle qualifies: Confirm that your car falls under Tanzania’s inspection program and meets the necessary standards.

- Choose an approved inspection agency: Work with a certified inspection agency in the exporting country to assess your vehicle’s condition, safety, and emissions compliance.

- Organize the necessary documents: Collect all essential paperwork, such as the commercial invoice, packing list, bill of lading, import permits, and the Certificate of Conformity (CoC).

- Complete the inspection: The agency will inspect your car for roadworthiness, safety features, and emissions compliance. Once it passes, you’ll receive a Certificate of Conformity or a similar document.

Ensure you submit all required documents to your clearing agent and Tanzania Customs at least seven days before your vehicle arrives to avoid delays or penalties.

What tax incentives are available for importing electric vehicles into Tanzania?

Electric vehicles (EVs) come with major tax perks when brought into Tanzania. Buyers can benefit from up to a 75% cut in import taxes and a full exemption from Value-Added Tax (VAT). These incentives make EVs a more affordable option for those looking to make eco-friendly choices.

Related Blog Posts

- Duty-Free Vehicle Import Rules in Tanzania

- Car registration costs in Tanzania

- What to Check Before Buying a Second-Hand Car in Tanzania

- Step-by-Step Guide to Buying a Car in Tanzania