Buying a car in Tanzania often requires financing, as most people don’t have the full amount upfront. Car loans from banks like Absa and Stanbic can cover up to 90% of a new car’s cost or 80% for a used one, with repayment terms ranging from 12 to 60 months. You’ll need a stable income, a down payment (10%-30%), and proper documentation such as ID, bank statements, and proof of employment. Interest rates vary, and options like hire purchase or leasing may suit different needs. To manage costs, compare lenders, plan for insurance, and ensure monthly payments fit your budget.

Car Financing Methods Available in Tanzania

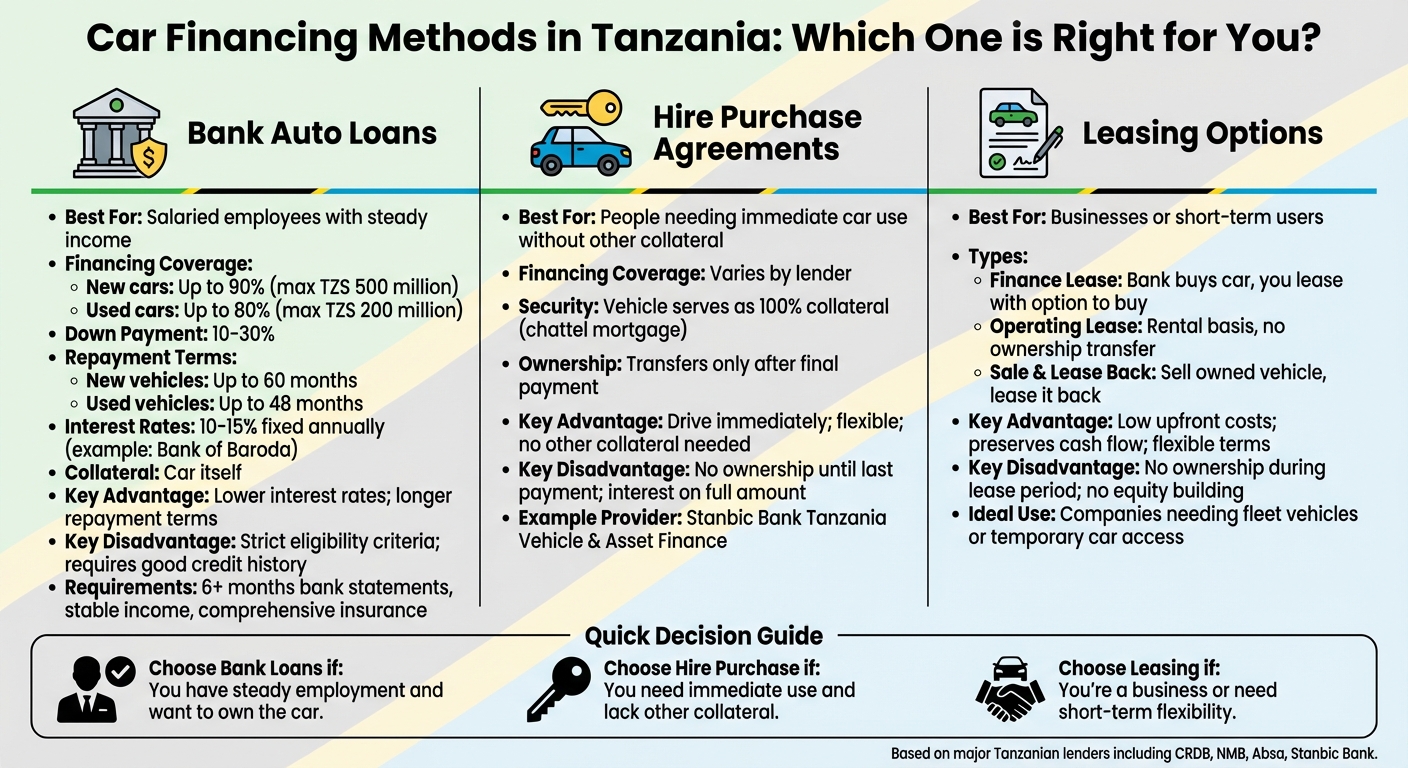

Car Financing Methods in Tanzania: Banks vs Hire Purchase vs Leasing Comparison

When you’re looking to buy a car in Tanzania, there are several financing options to consider. Each comes with its own set of requirements, costs, and perks. Below, we’ll break down the main methods so you can decide which one works best for your situation.

Bank Auto Loans

Bank auto loans are one of the most popular ways to finance a car in Tanzania. Major banks like CRDB, NMB, Absa Bank Tanzania, and Stanbic Bank offer loans that cover a significant portion of the vehicle’s price. For instance, Absa Bank Tanzania’s Vehicle Asset Finance can cover up to 90% of the cost for new cars (with a loan cap of TZS 500 million) and up to 80% for used cars (capped at TZS 200 million). Repayment terms can stretch up to 60 months for new vehicles and 48 months for used ones.

These loans are secured by the car itself until you’ve fully repaid the amount. To qualify, you’ll need a stable income, a good credit history, and at least six months of bank statements. Interest rates vary but can be either fixed or variable. Additionally, you’ll need to factor in the cost of comprehensive insurance, which is mandatory throughout the loan period. For example, Bank of Baroda offers fixed interest rates of about 10% annually for staff and around 15% for commercial clients.

What’s great about bank loans? They often come with competitive interest rates and longer repayment periods, making monthly payments more manageable. However, the requirements can be tough, especially for self-employed individuals or those with irregular income streams.

Hire Purchase Agreements

Hire purchase agreements, also known as asset-based term loans, allow you to use the car immediately while making regular payments. Ownership of the vehicle transfers to you only after the final installment. The lender uses the car itself as collateral, taking a chattel mortgage or debenture over the vehicle as security.

This option is particularly helpful if you don’t have other property to offer as collateral. For example, Stanbic Bank Tanzania provides Vehicle and Asset Finance under this model, where the vehicle serves as 100% security for the loan.

The main advantage here is flexibility – you can drive the car right away while spreading out payments. However, keep in mind that you’ll be paying interest on the entire borrowed amount.

Leasing Options

Leasing is another option, especially appealing for businesses or individuals who need a car for a limited time without committing to ownership. In Tanzania, there are two main types of leases:

- Finance leases: The bank buys the car and leases it to you in exchange for regular rental payments. At the end of the lease, you may have the option to buy the car or return it.

- Operating leases: Commonly used by employers, these allow employees to use cars on a rental basis without transferring ownership.

For businesses, Stanbic Bank Tanzania offers a Sale and Lease Back option. This allows companies to sell their fully owned vehicles to the bank to raise capital, then lease them back for an agreed period.

Leasing is ideal for preserving cash flow, as it requires lower upfront costs and offers flexibility. However, the downside is that you don’t build any ownership in the car during the lease period.

| Financing Method | Best For | Advantage | Disadvantage |

|---|---|---|---|

| Bank Auto Loan | Salaried employees with steady income | Lower interest rates; long repayment terms | Strict eligibility criteria; requires collateral |

| Hire Purchase | People needing immediate car use | Car itself serves as collateral | No ownership until last payment |

| Finance Lease | Businesses or short-term users | Low upfront costs; flexible terms | No ownership during lease term |

Each financing method has its pros and cons, so knowing the details will help you make an informed decision. Up next, we’ll discuss the application process and what you need to qualify.

Eligibility Requirements and Required Documentation

Eligibility Criteria

Before applying, make sure you meet the basic eligibility requirements. Most lenders look for applicants with a steady income, whether you’re employed by a company or running your own business. For salaried individuals, this often means having at least one year of continuous service with your current employer. Additionally, your total monthly debt – including the car loan – should not exceed 60% of your gross income. A solid credit history and a track record of timely repayments are also key factors.

The condition of the vehicle matters too. Many banks will only finance cars that are less than 10 years old. You’ll also need to make a down payment, typically between 10% and 30% of the car’s purchase price, though this can vary depending on the lender. If you’re a non-Tanzanian resident, a valid work permit is required.

Once you’ve confirmed your eligibility, you’ll need to gather the necessary documents to move forward with your application.

Required Documentation

Having the right paperwork ready can help speed up the process. Here’s what you’ll need:

- Identification: Provide a valid form of ID, such as a National ID card, passport, voter’s ID, or driver’s license.

- Proof of Employment: If you’re salaried, you’ll likely need an introductory letter from your employer, a copy of your employment contract, your employment ID, and your most recent three months’ pay slips to verify your income.

- Self-Employment Proof: For self-employed applicants, documents like contracts, invoices, and receipts will be required to confirm your business activities.

- Financial History: Most lenders will ask for bank statements covering the past three to six months.

- Vehicle Details: A proforma invoice from an approved vendor is essential. If you’re buying a used car, additional documents like a car evaluation report and a copy of the logbook or sale agreement may also be necessary.

- Legal Status: Non-Tanzanian applicants must provide a valid work permit.

| Document Category | Requirements |

|---|---|

| Identification | National ID, Passport, Voter’s ID, or Driver’s License |

| Employment Proof | Introductory letter, Employment ID, Employment contract |

| Income Verification | Latest three months’ pay slips |

| Financial History | Bank statements for the past 3–6 months |

| Vehicle Information | Proforma invoice from an approved vendor; for used cars, car evaluation report and logbook/sale agreement |

| Legal Status | Valid work permit (for non-Tanzanian applicants) |

Additionally, lenders require comprehensive insurance to cover the entire loan period. This is an upfront cost that you should plan for, as it safeguards both you and the lender throughout the loan term.

Comparing Interest Rates and Repayment Terms

Fixed vs. Variable Interest Rates

When choosing a loan, understanding the difference between fixed and variable interest rates is crucial for estimating your total cost and planning your budget. Fixed interest rates remain constant throughout the loan term, ensuring predictable monthly payments. For instance, Bank of Baroda offers a 10% fixed rate per annum for staff members, which increases to 15% for non-staff if they leave the organization. This stability makes it easier to manage your finances since you’ll always know what to expect.

On the other hand, variable interest rates, often based on your credit profile, might start lower but can fluctuate over time. While fixed rates provide the security of shielding you from potential rate hikes – especially valuable for long-term loans – variable rates might offer initial savings. Weighing these options alongside your repayment terms can help you make an informed decision.

Repayment Periods and Loan Amounts

The loan’s duration and amount play a significant role in determining your overall financing costs. In Tanzania, loan tenures typically range from 12 to 60 months. Extending your repayment period can lower your monthly payments but will significantly increase the total interest paid over time. For example, Absa Tanzania offers financing of up to TZS 500 million for new vehicles with a maximum term of 60 months, while used vehicles can be financed up to TZS 200 million over 48 months.

Financing terms also depend on whether the vehicle is new or used. New cars often qualify for up to 90% financing with a 10% down payment, whereas used cars are eligible for up to 80% financing, requiring a 20% down payment. A larger down payment reduces your loan principal and, by extension, the total interest you’ll pay over the life of the loan. Striking the right balance between a manageable repayment period and minimizing long-term costs is key to making a sound financial decision.

sbb-itb-d9186c2

Steps to Apply for Car Financing in Tanzania

Pre-Approval Process

Before diving into car shopping, it’s crucial to evaluate what you can afford. A loan calculator can help you estimate monthly payments and ensure they fit comfortably within your budget. Lenders like CRDB and NMB typically require a steady income and a solid credit history, so it’s wise to check your credit eligibility early to avoid surprises.

Next, decide on your down payment, which usually falls between 10% and 30% of the car’s value. Gather all necessary documents, such as your National ID (or passport/driving license), recent payslips (covering the past three months), and bank statements for the last three to six months. Once you’ve chosen a car, request a proforma invoice from an approved vendor – this is a key document that banks need to process your loan application.

Submitting the Application

With your budget sorted and documents in hand, you’re ready to submit your application. Fill out the lender’s finance form and include the proforma invoice. If you’re buying a used car or working with specific lenders, you may also need a professional car evaluation report to determine the loan amount. For self-employed applicants, additional proof of business – like contracts, invoices, or receipts – must be provided.

The bank will then verify your income, employment status, and creditworthiness. They’ll also confirm that the car is being purchased from an approved or reputable dealer. After this step, the process moves on to approval and fund disbursement.

Approval and Fund Disbursement

Once your application is approved, the bank disburses the funds directly to the dealership or vendor, as indicated in your proforma invoice. Some banks, such as Absa, even manage the entire purchase process for you after loan approval. Before the funds are released, you’ll need to activate comprehensive car insurance, which is usually mandatory to protect the lender’s interest in the vehicle.

After disbursement, your loan repayments are typically set up through automated systems, such as direct salary deductions or standing orders from your savings account. Before signing the final agreement, carefully review the terms for any hidden fees, including processing charges, legal fees, and penalties for late payments or early loan settlement. Pay close attention to clauses about job termination – some banks, like Bank of Baroda, may increase your interest rate from 10% to 15% if you leave your employer before fully repaying the loan. Keep in mind that the car serves as collateral during the repayment period, and most lenders cap monthly deductions at 60% of your gross salary to ensure the loan remains manageable.

Managing Your Car Loan Effectively

Timely Payments and Credit Building

Making your car loan payments on time isn’t just about avoiding late fees – it’s a key step toward building a solid credit history, which can open doors to better loan terms in the future. One way to stay consistent is by automating your payments. Many Tanzanian banks, like Bank of Baroda and Stanbic Bank, provide systems that automatically deduct loan installments from your salary or savings account. If your employer supports a "Guaranteed" or "Administrative" payment scheme, your loan payments might be directly deducted from your paycheck, making it even easier to avoid missed deadlines.

Keeping an eye on your loan statements is another smart move. Regularly reviewing them helps you track your progress and catch any errors. If you find yourself in a temporary financial crunch, you might consider short-term options like CRDB’s salary advance, which offers up to 50% of your monthly salary at a 5% interest rate.

Staying on top of payments is just the beginning – effective loan management also requires thoughtful planning.

Strategies for Managing Loan Repayments

Once you’ve nailed timely payments, it’s time to think about the bigger picture. Owning a car comes with extra costs like fuel, maintenance, and insurance, so adjusting your budget to account for these is essential. Before committing to a loan, using a loan calculator can help ensure that all these expenses fit comfortably within your disposable income. If your financial situation improves, consider paying off your loan early to save on interest over time.

Comprehensive car insurance is another must-have. It shields you from major financial setbacks in case of an accident or total loss of your vehicle. If the cost of insurance feels overwhelming, some lenders offer Insurance Premium Financing (IPF), allowing you to spread out the payments. Also, take a close look at your loan agreement for any hidden fees or early repayment penalties. Make sure you’re aware of any interest rate adjustments that might be tied to changes in your employment status before you finalize the loan.

Effective car loan management isn’t just about paying on time – it’s about planning for every angle of ownership.

Conclusion

Financing a car in Tanzania requires careful budget planning and a thorough review of available financing options. Before committing to any agreement, it’s essential to compare interest rates and repayment terms from various lenders. Traditional banks often provide lower interest rates compared to microfinance institutions, but they also tend to have stricter eligibility criteria. Keep in mind that while longer repayment terms might make monthly payments more manageable, they also increase the total interest you’ll pay over time.

The size of your down payment can significantly impact your overall costs. Most lenders expect an upfront payment ranging from 10% to 30% of the car’s value. Opting for a larger down payment can reduce both the loan amount and the interest you’ll owe.

Don’t forget to account for ongoing expenses beyond the initial costs. Make sure your budget can comfortably cover the loan payments, as well as fuel, maintenance, and insurance. Using a loan calculator beforehand can give you a clearer picture of how these expenses fit into your financial plan.

FAQs

What’s the difference between bank auto loans, hire purchase, and leasing when financing a car in Tanzania?

When it comes to financing a car, you’ve got three popular options: bank auto loans, hire purchase, and leasing. Each comes with its own approach to ownership, payments, and responsibilities.

With a bank auto loan, you borrow money from a bank to buy the car outright. Typically, you’ll need to make a down payment – usually between 10% and 30% of the car’s price – while the bank covers the rest. The car is yours from the start, but you’ll repay the loan in fixed monthly installments over 1 to 5 years, along with interest, which often falls between 16% and 20% annually. Maintenance and other costs? Those are all on you.

Hire purchase works a bit differently. You get to use the car while making regular payments, but you don’t officially own it until you’ve made the final payment. Like bank loans, hire purchase agreements require a down payment, and the interest rates are usually in the same ballpark. During the payment period, you’re responsible for maintaining the car.

Leasing, on the other hand, is more like renting. You pay a monthly fee to use the car for a set term, typically 2 to 5 years, but the leasing company retains ownership. Some leases even include maintenance as part of the deal. Once the lease ends, you have a few choices: return the car, renew the lease, or sometimes even buy the car outright.

To sum it up: bank loans give you immediate ownership, hire purchase lets you own the car after the final payment, and leasing offers temporary use without the commitment of ownership. Each option has its perks, so the right choice depends on your priorities and financial situation.

What do I need to qualify for a car loan in Tanzania?

To be eligible for a car loan in Tanzania, lenders typically require you to meet several important criteria. First, you’ll need to demonstrate a stable income, whether through a regular salary or consistent business earnings, with at least six months of documented financial records. A good credit history is also essential, as it can improve your chances of getting better interest rates. Additionally, most lenders expect a down payment – usually 10–30% for new vehicles and 30–50% for used ones – so it’s important to have these funds ready.

You’ll also need to prepare the necessary paperwork. This includes a valid ID or passport, recent bank statements (typically covering the last three months), and a purchase agreement or pro forma invoice for the car. Some lenders may request additional documents, such as an employment letter or proof of a fixed-term contract, if applicable. It’s also a good idea to calculate your debt-to-income ratio beforehand, as most lenders prefer that your total monthly debt payments don’t exceed 60% of your gross income. Meeting these requirements puts you in a strong position to secure a car loan and move forward with your application.

Should I choose a fixed or variable interest rate for my car loan?

When choosing between a fixed or variable interest rate for your car loan, it all comes down to your financial goals and how much risk you’re willing to take. A fixed interest rate keeps your monthly payments steady and predictable, which can make budgeting a lot simpler. In contrast, a variable interest rate moves with the market – this could mean lower payments when rates drop, but it also opens the door to higher payments if rates climb.

If stability and avoiding surprises are your priorities, a fixed rate is likely the safer choice. But if you’re okay with some uncertainty and believe interest rates might go down, a variable rate could potentially save you money in the long run. Take a close look at your financial situation and where you think rates are headed before making your decision.

Related Blog Posts

- Car Financing in Tanzania: Pros and Cons

- Car Loans in Tanzania: What to Know

- Top 5 Banks Offering Car Loans in Tanzania

- How to Finance a Car Purchase in Tanzania: Loans, Leasing & More