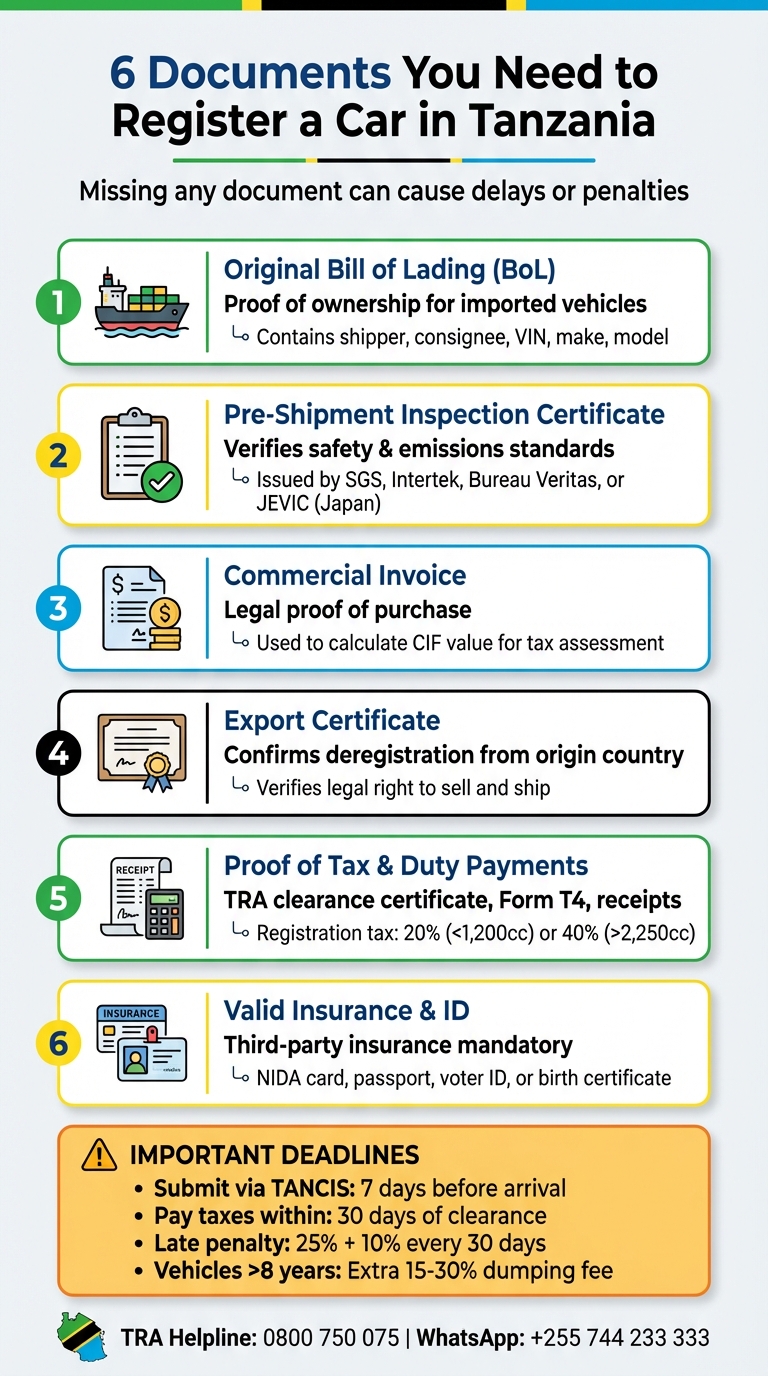

To register your car in Tanzania, you’ll need six key documents. Missing any of these can delay the process or result in penalties. Here’s what you need:

- Original Bill of Lading (BoL): Proof of ownership for imported vehicles.

- Pre-Shipment Inspection Certificate: Confirms the vehicle meets Tanzanian safety and emissions standards.

- Commercial Invoice: Legal proof of purchase and basis for tax calculations.

- Export Certificate: Verifies the vehicle’s deregistration in its country of origin.

- Proof of Tax and Duty Payments: Includes receipts for import duties, VAT, and other fees.

- Valid Vehicle Insurance and Identification: Mandatory third-party insurance and personal ID (e.g., passport, NIDA card).

For imported vehicles, work with a Licensed Clearing and Forwarding Agent (CFA) to submit documents via the Tanzania Customs Integrated System (TANCIS) at least seven days before the vehicle’s arrival. Delays or incomplete submissions can lead to fines: 25% for initial delays and an additional 10% every 30 days.

Quick Tip: Vehicles older than 8 years incur extra fees (15%-30%). Ensure all details match across documents to avoid complications.

6 Required Documents for Car Registration in Tanzania

1. Original Bill of Lading

The Original Bill of Lading (BoL) is a crucial document that serves as proof of ownership for imported vehicles. Issued by the shipping carrier after the vessel departs, it acts as evidence of the carriage contract, receipt of the cargo, and legal ownership.

Without this document, you won’t be able to claim your vehicle at the Dar es Salaam port. It contains all the key details required by the Tanzania Revenue Authority (TRA) for vehicle registration. This includes information about the shipper and consignee, a detailed description of the cargo (such as the vehicle’s make, model, and VIN), as well as its weight, volume, and the ports of loading and discharge. The BoL plays a central role in customs clearance and ensuring compliance with registration requirements.

To avoid delays or penalties, work with a Licensed Clearing and Forwarding Agent (CFA) to submit your Bill of Lading through TANCIS at least seven days before the shipment arrives.

It’s important that your shipper provides accurate "Shipping Instructions" to the carrier, as these details are used to generate the Bill of Lading. Any errors in this document can lead to customs delays. If you’re not using a Telex Release (an electronic alternative for cargo release), ensure the exporter sends the original physical document securely via courier.

Once customs clearance is complete, and your Bill of Lading has been processed, you’ll receive a Customs Clearance Certificate. This certificate is essential for submitting your formal vehicle registration application. Getting an accurate BoL is the first step to ensuring a smooth registration process with the TRA.

2. Pre-Shipment Inspection Certificate

The Pre-Shipment Inspection Certificate is a must-have for a smooth registration process with the TRA. This document verifies that the imported vehicle meets Tanzanian safety, emissions, and age standards. It’s issued by an approved inspection center.

Without this certificate, customs clearance and TRA registration simply can’t proceed. A TBS-authorized third-party agency must handle the inspection in the vehicle’s country of origin. Agencies like SGS, Intertek, and Bureau Veritas are commonly used for this purpose. For vehicles imported from Japan, the Japan Export Vehicle Inspection Centre (JEVIC) is specifically recognized for conducting these inspections. Since July 20, 2022, all used vehicles from Japan must undergo the Pre-Shipment Verification of Conformity (PVoC) in Japan before shipment. This step is essential and lays the groundwork for all subsequent registration requirements.

The certificate itself includes key details such as safety checks (brakes, lights, and alignment), emissions compliance, age verification, and the results of a physical assessment. This process ensures that only roadworthy vehicles enter the Tanzanian market, preventing substandard imports.

Make sure to complete the inspection and secure the certificate before the vehicle is shipped. If a consignment lacks a Certificate of Conformity (CoC), it will face penalties and additional Destination Inspection fees. Also, keep in mind the vehicle’s age – cars older than 8 years are subject to an extra "Dumping Fee" (Excise Duty on Age), which ranges from 15% to 30% on top of regular taxes. Lastly, don’t confuse this certificate with the local Roadworthiness Certificate, which is a separate requirement. The Roadworthiness Certificate involves a TRA-approved safety and emissions test valid for 30 days.

3. Commercial Invoice

The Commercial Invoice is your key document to prove ownership of the vehicle and serves as a legal record of purchase. Beyond confirming ownership, it plays a critical role in customs clearance, as the Tanzania Revenue Authority (TRA) uses it to calculate the CIF (Cost, Insurance, and Freight) value. This CIF value is the foundation for determining all applicable taxes during the customs process.

To meet TANCIS requirements, the invoice must include a detailed description of the vehicle. Vague or incomplete information will lead to rejection. Make sure to provide specifics such as the vehicle’s make and model, chassis number, VIN (Vehicle Identification Number), engine capacity (in cc), year of manufacture, purchase price, and the identification details of both the buyer and seller. Double-check that the chassis number and VIN match the Export Certificate and the vehicle itself.

Only submit the final invoice – pro-forma invoices are not accepted by TANCIS. The declared invoice value will determine your tax obligations, which include:

- Import Duty: Ranges from 0% to 25%, depending on the vehicle category.

- VAT: Charged at 18% of the CIF value.

- Withholding Tax: Set at 6%.

- Excise Duty: Calculated based on the vehicle’s engine capacity and age.

Additionally, registration fees typically range between TZS 150,000 and TZS 300,000.

Submit the invoice through a Licensed Clearing and Forwarding Agent (CFA) at least seven days before your vessel arrives. This early submission helps address any discrepancies before port storage fees – usually $20 to $40 per day plus VAT – begin to accumulate. If the invoice is not in English, you’ll also need to pay a $50 translation fee.

Keep in mind, if the TRA questions the declared value or finds inconsistencies with other documents, they may disregard your stated price and calculate taxes based on their own valuation. To avoid delays or penalties, carefully verify all details and retain the original invoice for your records.

4. Export Certificate

The Export Certificate, also known as a De-registration Certificate, is an official document issued by the motor vehicle authority in the country where your car was previously registered. This document confirms that the vehicle has been legally removed from that country’s registry and verifies that the exporter had the legal right to sell and ship it to Tanzania.

This certificate is essential because, without it, the vehicle remains in a legal gray area. Tanzania requires this document to ensure the vehicle isn’t registered elsewhere and to avoid any future ownership disputes. Additionally, the Tanzania Revenue Authority (TRA) uses the certificate’s technical information – such as the year of manufacture, engine capacity, and chassis number – to calculate customs duties and registration fees. This step is crucial for ensuring you receive the correct paperwork from your seller.

For vehicles imported from Japan, the Export Certificate is often issued or verified by organizations like the Japan Export Vehicle Inspection Centre (JEVIC). Always request the original certificate from your seller or shipping agent, as the TRA does not accept photocopies. If you’re purchasing a used vehicle from a neighboring East African country, make sure the seller has secured a deregistration letter to legally complete the ownership transfer.

It’s important to cross-check the technical details on the Export Certificate with your other vehicle documents. Pay special attention to the "date of first registration", as it determines the vehicle’s age for taxation purposes. Vehicles over 8 years old are subject to an additional dumping fee, which can range from 15% to 30% on top of standard taxes.

The Export Certificate works alongside your Pre-Shipment Inspection Certificate to confirm that your vehicle complies with Tanzanian standards for age, emissions, and safety requirements. Keep the original document safe, as it will need to be submitted with Form VR1 during the registration process.

sbb-itb-d9186c2

5. Proof of Tax and Duty Payments

Having proof of tax and duty payments is just as important as your other documents when it comes to completing your vehicle registration. Once your vehicle clears customs, make sure to secure official proof of all tax and duty payments made to the TRA. Key documents include the TRA clearance certificate, Form T4, and Duty/VAT receipts. These are essential and must be submitted alongside the rest of your paperwork to meet the registration requirements.

For newly imported vehicles, all relevant import taxes and levies apply. The registration tax is calculated based on the engine size: 20% for engines under 1,200 cc and 40% for those over 2,250 cc. However, if VAT has already been paid on your vehicle, the registration tax is reduced to a flat fee of TZS 250,000.

The TRA determines your vehicle’s customs value using the Used Motor Vehicle Valuation System (UMVVS), which might result in a higher valuation than your purchase price to address under-invoicing concerns. To get a better idea of your tax obligations before importing, you can use the TRA’s online portal at gateway.tra.go.tz/umvvs for an estimate. Keep in mind, vehicles older than 8 years face an additional "Dumping Fee", which adds between 15% and 30% in excise duties on top of the standard taxes.

To handle payments, it’s best to work with a Licensed Clearing and Forwarding Agent (CFA). Payments are processed through the Tanzania Customs Integrated System (TANCIS). Ensure all payments are completed within 30 days of customs clearance to avoid penalties – starting with a 25% fine for the first delay, followed by 10% for every additional 30 days. Keep all original receipts to guarantee a smooth registration process.

Always retain your receipts and clearance documents for future reference.

6. Valid Vehicle Insurance and Identification

When it comes to registering your vehicle, having valid insurance and proper identification is just as crucial as the other required documents. To complete the process, you’ll need third-party insurance and an acceptable form of identification. Third-party insurance is mandatory because it covers liability for damage or injury to others. While this basic coverage is required, opting for comprehensive insurance is a smart choice to protect against theft and accidental damage.

To move forward with your registration, you must present a valid insurance certificate. Without it, you risk facing fines or even legal consequences. Additionally, your insurance details are logged into the national Register of Motor Vehicles and the Vehicle Licensing Management Platform (VIMS).

For identification, you can provide one of the following: a NIDA card, passport, voter ID, or birth certificate. If you’re a foreign national, your passport will be required. Along with this, proof of address is necessary when filling out Form VR1 for new vehicle registrations or Form VR2 for transferring ownership.

For tourists visiting for less than three months, out-of-country insurance is acceptable. However, residents and those importing vehicles for long-term use must secure local insurance. If you’re registering a commercial vehicle, you’ll need a specialized commercial insurance policy.

Document Requirements: Imported vs. Local Vehicles

When it comes to vehicle documentation, imported and locally purchased vehicles have very different requirements. Imported vehicles demand extra international customs paperwork, while local vehicles require only basic documents for ownership transfer.

For imported vehicles, you’ll need international customs documents and must work with a Licensed Clearing and Forwarding Agent (CFA) to handle the process through the Tanzania Customs Integrated System (TANCIS). On the other hand, locally purchased vehicles involve fewer steps. The primary focus is on transferring ownership, which requires a vehicle logbook and a sales invoice. Ownership transfer is completed using Form VR2, as opposed to the new registration process for imports, which uses Form VR1.

Both imported and local vehicles must meet standard requirements, such as obtaining a local Roadworthiness Certificate from a TRA-approved inspection center. This certificate is valid for 30 days.

If you’re importing a vehicle that’s over 8 years old, be prepared to pay an additional "Dumping Fee" ranging from 15% to 30%. This fee does not apply to locally purchased vehicles since they are already within the country. To avoid unexpected costs, check the TRA Motor Vehicle Valuation System (UMVVS) before importing to see if your vehicle falls into this category.

For imported vehicles, it’s essential to submit clearance documents via TANCIS at least 7 days before the vessel arrives. Once customs clearance is complete, registration fees must be paid within 30 days to avoid penalties. After finalizing the registration process, vehicle logbooks are typically issued within 7 to 14 working days.

Conclusion

Thorough preparation of your documents can make the registration process smoother and help you avoid unnecessary penalties. Ensure you gather all required paperwork, as the Tanzania Customs Integrated System (TANCIS) automatically rejects incomplete declarations. Missing even a single document can bring your registration to a standstill. Additionally, failing to pay registration taxes on time can result in a 25% penalty, with an extra 10% added for every 30 days of delay.

Having proper documentation also protects you legally. It ensures the previous owner cannot be held liable for fines, accidents, or illegal activities linked to the vehicle. Be mindful that roadworthiness certificates are valid for only 30 days. Completing your registration before this certificate expires saves you from the hassle and cost of re-testing.

For imported vehicles, it’s essential to work with a TRA-licensed Clearing and Forwarding Agent and submit all necessary documents in TANCIS at least seven days before the vessel’s arrival. Use the UMVVS portal early to estimate taxes and avoid unexpected costs. This proactive approach helps minimize delays and ensures compliance throughout the process.

If you’re uncertain about any step, don’t hesitate to contact the TRA directly. You can reach them through their toll-free numbers (0800 750 075, 0800 780 078, or 0800 110 016) or their WhatsApp line (+255 744 233 333). For locally purchased vehicles, it’s wise to involve a licensed advocate to draft a legally binding sales agreement and ensure the ownership transfer is handled correctly.

Lastly, keep photocopies of all original documents and verify with TRA or LATRA that there are no outstanding loans or fines tied to the vehicle before completing the registration process.

FAQs

What should I know if my car is over 8 years old?

If your car is over 8 years old, it falls under the category of a used import in Tanzania. This classification means you’ll need to pay an additional excise duty on top of the usual import taxes. The purpose of this extra tax is to reduce the environmental impact by discouraging the importation of older vehicles, which typically produce higher emissions. Vehicles aged between 8 and 10 years face a smaller surcharge compared to those older than 10 years.

When it’s time to register the vehicle, you’ll need to show proof that this excise duty has been paid – usually in the form of a receipt from the Tanzania Revenue Authority. Without this documentation, your car won’t be cleared for registration, and you won’t be able to get valid license plates. It’s worth noting that importing older cars not only increases costs but also adds an extra step to the registration process.

How can I make sure my Bill of Lading is correct?

To make sure your Bill of Lading is correct, carefully review all the details. This includes the shipper and consignee information, vessel name, shipment dates, cargo description, weight, and container numbers. Double-check that these match exactly with your invoice, packing list, and any other import documents.

After confirming everything is accurate, submit the finalized Bill of Lading through the Tanzania Customs Integrated System (TANCIS). Precision is key here, as the system will automatically reject any incomplete or unclear declarations. Following these steps can help you avoid unnecessary delays during the registration process.

What happens if I submit my car registration documents late?

The penalties for submitting car registration documents late in Tanzania aren’t explicitly outlined. The Motor Vehicles (Tax on Registration and Transfer) Act does mention that failing to comply, such as with late submissions, could lead to penalties. However, it doesn’t specify exact fines or other consequences for this situation.

For precise details, it’s a good idea to reach out to the Tanzania Revenue Authority (TRA) directly or refer to the full text of the Motor Vehicles Act. They can give you clear guidance on any fines or repercussions related to late submissions.

Related Blog Posts

- Car registration costs in Tanzania

- Step-by-Step Guide to Buying a Car in Tanzania

- How to transfer vehicle ownership in Tanzania: full guide

- Tanzania car transfer process: documentation & timelines