Car insurance is mandatory in Tanzania, but finding the best deal can save you money while ensuring proper coverage. Here’s a quick guide to help you navigate your options and pick the right policy:

- Types of Coverage: Choose between Third-Party Only (basic legal requirement), Third-Party Fire and Theft (adds protection against fire and theft), or Comprehensive (covers your own vehicle too).

- Top Providers: Consider companies like Jubilee, NIC, Britam, Alliance, and ZIC. Each offers unique benefits like fast claims, affordability, or digital tools.

- Digital Tools: Use platforms like BimaSokoni or TIRA Motor Insurance System to compare quotes, verify policies, and pay online or via mobile services.

- Cost-Saving Tips: Install anti-theft devices, maintain a clean driving record, bundle policies, or negotiate with insurers for discounts.

- Common Mistakes: Avoid providing incorrect details, skipping policy reviews, or filing claims for minor repairs that might void your no-claims bonus.

Key takeaway: Understand your needs, compare providers, and use digital tools to secure affordable and reliable car insurance in Tanzania.

Types of Car Insurance Coverage in Tanzania

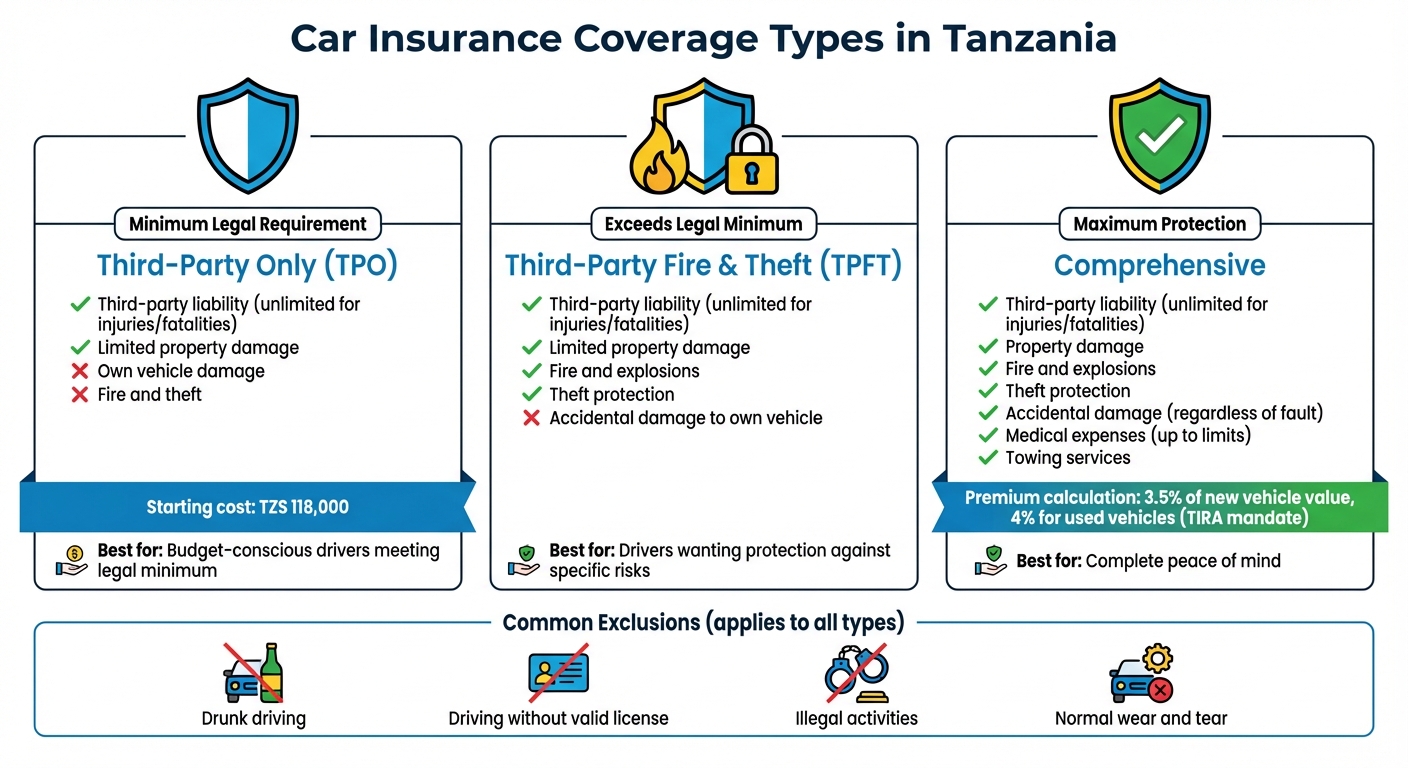

Car Insurance Coverage Types in Tanzania: TPO vs TPFT vs Comprehensive Comparison

In Tanzania, car insurance options are designed to meet legal requirements while offering varying levels of financial protection. Here’s a breakdown of the three main types:

Third-Party Liability Insurance is the most basic and legally required coverage under the Motor Vehicle Insurance Ordinance. This policy takes care of unlimited claims for third-party injuries or fatalities and offers limited coverage for property damage. However, it does not provide compensation for damage to your own vehicle. If you’re looking for more protection beyond this minimum, you might want to explore additional coverage options like fire and theft insurance.

Third-Party Fire and Theft Coverage enhances the basic policy by including protection for your vehicle against fire, explosions, and theft. This type of policy is especially useful if you’re concerned about these specific risks but don’t require full coverage.

Comprehensive Motor Insurance offers the most extensive coverage available. It includes everything covered by the other two policies – third-party liabilities, fire, and theft – while also protecting against accidental damage to your own vehicle, regardless of fault. Some comprehensive policies even come with extra perks, such as medical expense coverage and towing services up to specified limits. However, it’s important to note that comprehensive insurance typically excludes claims related to drunk driving, driving without a valid license, illegal activities, or normal wear and tear.

| Coverage Type | Third-Party Liability | Fire & Theft (Own Vehicle) | Accidental Damage (Own Vehicle) | Legal Requirement |

|---|---|---|---|---|

| Third-Party Only (TPO) | Yes | No | No | Minimum Legal Requirement |

| Third-Party Fire & Theft (TPFT) | Yes | Yes | No | Exceeds Legal Minimum |

| Comprehensive | Yes | Yes | Yes | Exceeds Legal Minimum |

How to Compare Insurance Providers in Tanzania

When choosing an insurance provider in Tanzania, it’s important to weigh factors like claims handling, service quality, and coverage options. Below, we’ll walk you through how to review insurers, compare quotes, and make the most of manufacturer-backed benefits to secure the best deal.

Review Major Tanzanian Insurance Companies

Start by exploring the top insurance providers in Tanzania to find one that matches your needs:

- NIC Insurance: As a government-backed insurer, NIC offers financial stability, an extensive branch network, and a mobile app for tracking claims and policies in real time.

- Jubilee Insurance: Known for its fast claim settlements and 24/7 emergency assistance, Jubilee is a strong option for those who prioritize quick support during critical situations.

- Alliance Insurance: Offers a broad coverage network, though its premium-tier services come at a higher cost.

- Britam Insurance: Provides customizable plans and safe driver discounts, adopting a digital-first approach. However, some eligibility requirements can be strict.

- ZIC (Zanzibar Insurance Corporation): Ideal for Zanzibar residents, ZIC offers affordable premiums and government backing but has limited services outside the islands.

Use Comparison Platforms

Online tools like BimaSokoni make it easy to compare insurance options side by side and even allow mobile payments for private, commercial, and passenger vehicles. Once you’ve chosen a policy, confirm its registration through the TIRA Motor Insurance System (MIS) to ensure it’s legitimate. Additionally, banks like Absa Bank Tanzania and Coop Bank can assist with documentation, endorsements, and renewal reminders. Notably, Coop Bank partnered with NIC in January 2026 under a three-year agreement to streamline these services.

Consider Manufacturer-Backed Insurance

If you drive a Toyota, manufacturer-backed coverage through Toyota Protect – offered by Salute Insurance Agency Limited (SIAL) – might be worth exploring. This coverage ensures certified repairs using genuine parts and offers a range of plans:

- Basic Third Party coverage starts at TZS 118,000.

- Comprehensive plans include benefits like cashless claims, replacement vehicles during repairs, and medical expense coverage up to TZS 500,000.

Additionally, vehicles equipped with tracking devices may qualify for a 5% premium discount. This type of insurance not only ensures high-quality repairs but also helps maintain your vehicle’s warranty.

Digital Tools for Checking and Buying Insurance

The insurance landscape in Tanzania has embraced digital advancements, making it easier than ever to verify policies, compare quotes, and purchase coverage online. These tools simplify the process, ensuring you get legitimate and affordable insurance without hassle.

TIRA Motor Insurance Verification

The TIRA Motor Insurance System (TIRA MIS) is the go-to platform for confirming whether your vehicle insurance is valid and issued by an authorized insurer. You can verify your coverage using one of four identifiers:

- Vehicle registration number (e.g., T123ABC)

- Sticker number from your windshield

- Cover note reference number from your insurance certificate

- Chassis number (VIN) for new or unregistered vehicles

Once verified, the system provides details about your policy, including its status, the issuing company, and coverage dates. If the system shows "no results found", it’s a sign to contact your insurer and ensure your policy details are properly uploaded to the TIRA MIS database.

Mobile and USSD Services

For those without internet access, USSD services offer a quick and straightforward way to check or buy insurance. To verify your policy, dial *152*00#, navigate to Financial Services, select Insurance, and input your vehicle registration number. Your policy details will then be sent via SMS.

If you’re looking to purchase insurance, dial *150*71# for T-PESA‘s insurance service. Follow these steps:

- Select the type of coverage you need.

- Enter your vehicle registration number and Taxpayer Identification Number (TIN).

- Confirm the payment using your T-PESA PIN.

Once completed, your digital cover note will be sent to you via email or SMS. The entire process is quick and efficient, taking just a few minutes.

Online Quote Portals

Websites like Bimaonline.co.tz (Bimasokoni) make buying car insurance a breeze. Start by selecting your vehicle type – whether it’s a private car, motorcycle, passenger vehicle, or commercial vehicle. Then, input your registration details to receive instant quotes from various insurers.

After comparing quotes, you’ll be provided with a GePG control number for payment. You can pay using popular mobile money services like:

- M-Pesa (*150*00#)

- Airtel Money (*150*60#)

- Tigo Pesa (*150*01#)

Once payment is confirmed, your digital policy documents are issued, and you can immediately verify your registration through TIRA MIS. To make the process smoother, ensure you have your vehicle registration number and Taxpayer Identification Number (TIN) ready before you start.

sbb-itb-d9186c2

How to Lower Your Insurance Costs

Digital tools make managing your insurance policy easier while also helping you spot ways to save money. Affordable car insurance in Tanzania ensures you can maintain solid coverage without breaking the bank. By understanding what affects your premiums and using available discounts, you can trim your annual costs while staying protected.

What Affects Your Premium

Your insurance premium is shaped by the type of coverage you choose. For example, Third-Party Only (TPO) policies can cost as little as TZS 118,000. On the other hand, comprehensive insurance, as mandated by TIRA, is calculated at 3.5% of a new vehicle’s value and 4% for used vehicles.

Other factors, like your vehicle’s market value, age, condition, and engine size, also play a role. Commercial vehicles often have higher rates, ranging from 4.25% to 5.5% of their value. A clean driving history can help lower your costs, while frequent claims typically flag you as a higher risk, which can drive up premiums.

Understanding these factors can help you identify opportunities to save money.

Find and Use Available Discounts

Discounts are a great way to cut costs without sacrificing coverage. One of the most effective ways is to build a No-Claims Bonus (NCB) by maintaining a claim-free record. After three to five years, this could qualify you for discounts ranging from 15% to 25%.

Installing security features like GPS trackers, alarms, or immobilizers can also lead to savings. For instance, Salute Insurance Agency Limited offers a 5% discount for vehicles equipped with tracking devices. Bundling your motor insurance with other policies, such as home or business coverage, can further reduce costs by 15% to 25%.

You can also opt for a higher voluntary excess. For example, raising your deductible from $500 to $1,000 could cut your premiums by 15%–25%. Paying your premiums annually instead of monthly might save an additional 5% to 10% by avoiding administrative fees.

Tips for Negotiating Lower Rates

Beyond discounts, negotiating directly with insurers can lead to even lower premiums. Start by collecting at least five quotes to compare rates for the same coverage. This gives you leverage when discussing costs. Share competitor quotes with your preferred insurer’s retention department – they often have the flexibility to offer discretionary discounts.

Be sure to highlight your strengths during negotiations. Mention your clean driving record, any newly installed security features, or your lower annual mileage. Drivers who log fewer than 7,500 miles a year, for instance, save an average of $86 compared to high-mileage drivers. Also, ask about lesser-known discounts, such as those for professional associations, alumni groups, or switching to paperless billing.

If your vehicle is worth less than $4,000, consider dropping comprehensive and collision coverage. This move could cut your premiums by up to 50% while still meeting legal third-party liability requirements. Finally, review your policy every year. As your car ages or your driving record improves, you may qualify for additional savings or loyalty discounts.

Mistakes to Avoid When Buying Car Insurance

Common Insurance Mistakes

Choosing Third-Party Only (TPO) insurance might meet the legal requirements, but it leaves you vulnerable if your car is damaged in an accident or hit by an uninsured driver. While TPO is often cheaper, it can become a costly decision if you’re at fault in an accident or face unexpected damages.

Providing incorrect details about your vehicle or driving history can result in higher premiums or even claim denials. Many people also overlook policy exclusions, only to find out too late that their insurance doesn’t cover issues like mechanical breakdowns, normal wear and tear, or incidents involving unlicensed or impaired driving.

"Even comprehensive coverage has exclusions. Common ones include: Driving without a valid license, drunk driving, using the car for illegal activities, normal wear and tear." – AutoMag.tz

Another common pitfall is filing claims for minor repairs. While it might seem like you’re saving money, doing so can void your no-claims bonus, which typically reduces future premiums by 15% to 25%. Before filing a small claim, weigh the cost of paying out-of-pocket against the potential savings on future premiums.

In addition to selecting the right coverage and providing accurate information, ensuring your policy documentation is error-free is just as important.

Verify Your Policy and Understand Claims

Mistakes in your policy can cause major headaches when it’s time to file a claim. Taking the time to verify everything upfront can save you from unnecessary stress later on.

After purchasing your policy, review the documents carefully. Check that your registration number, TIN, and vehicle classification are correctly listed on your insurance certificate. Errors in these areas can lead to legal issues during traffic stops or delays in processing claims. You can use digital tools like T-PESA (_150_71#) or TIRA’s verification systems to confirm your policy’s validity.

Knowing how to file a claim before an accident happens can also save you time and frustration. Keep a claims kit in your car with essential items like a copy of your driver’s license, your vehicle logbook, and your insurer’s contact information. If you’re in an accident, file a police report immediately to obtain a Police Abstract, as this document is required for all motor insurance claims in Tanzania. Remember, insurers often require immediate notification of accidents, and delays could result in your claim being denied.

| Required Document | Purpose |

|---|---|

| Police Abstract | Official accident record required by all Tanzanian insurers |

| Completed Claim Form | Formal notification of the loss to your insurance company |

| Copy of Driver’s License | Verifies the driver was legally authorized at the time of the incident |

| Garage Quotation/Invoices | Supports the financial amount being claimed for repairs |

| Logbook/Transfer Form | Required for total loss or vehicle theft cases |

Taking these steps ensures you’re prepared for the unexpected and helps avoid unnecessary complications when dealing with your insurance.

Conclusion

Getting the best car insurance deal in Tanzania requires a clear understanding of your coverage needs, careful comparison of providers, and smart use of tools to verify your policy. Start by deciding whether basic or comprehensive coverage suits your situation. Then, explore platforms and discounts to help bring down your costs.

Digital tools like BimaSokoni make it easy to compare quotes from local insurers in less than a minute. Be sure to check that the rates align with TIRA’s guidelines, which suggest a minimum of 3.5% for new vehicles and 4% for used ones.

You can reduce your premiums by taking a few proactive steps. For instance, installing anti-theft devices might earn you up to a 5% discount, while increasing your excess or bundling policies can also lead to savings. Handling minor repairs on your own could help preserve your no-claims bonus, potentially lowering future premiums by 15% to 25%. Don’t forget to use mobile tools like the TIRA system to verify your vehicle’s registration number, TIN, and classification. Additionally, ensure your insurer has a solid track record for settling claims and review exclusions, especially those related to unlicensed or impaired driving.

Though only 15% of Tanzanian adults currently access more than one insurance product, the market is filled with competitive options. By comparing providers, understanding your policy terms, and taking advantage of discounts, you can secure reliable coverage without overpaying. A little effort today can lead to better protection and significant savings down the road.

FAQs

What factors influence car insurance premiums in Tanzania?

Car insurance premiums in Tanzania are shaped by several important factors. One of the biggest considerations is the type of coverage you choose. Whether you opt for third-party only, third-party fire and theft, or comprehensive coverage, your choice will directly influence the cost. Comprehensive plans tend to be more expensive since they provide a wider range of protection.

Another key factor is the value and age of your vehicle. Newer cars or those with a higher market value usually come with steeper premiums because the cost to repair or replace them is higher. Beyond that, your driving history, how you use your car, and even where you park it overnight can all play a role in determining your premium.

To save money, take the time to compare different insurance options, assess what coverage you actually need, and look into any discounts or special offers that insurers might provide.

How can I check if my car insurance policy is valid online?

To check if your car insurance policy is active, head to your insurer’s official website or use Tanzania’s TIRA MIS verification tool. All you need to do is input key details such as your policy number, vehicle registration, cover note reference, sticker number, or VIN. In just a few moments, you’ll know your coverage status – giving you confidence that everything is in order.

What are the advantages of choosing comprehensive car insurance over third-party coverage?

Comprehensive car insurance provides a far more extensive level of protection compared to third-party coverage. While third-party policies only cover damages or injuries you might cause to others, comprehensive insurance steps up by also covering your own vehicle. This includes risks like theft, fire, vandalism, and accidents – no matter who is at fault.

This coverage can be a lifesaver, offering financial protection in a variety of situations. It’s especially valuable if you own a new or high-value car, where repair or replacement costs can quickly add up. Choosing comprehensive insurance helps shield you from unexpected bills and ensures both your vehicle and liabilities are covered.

Related Blog Posts

- How to insure your car in Tanzania

- Where to buy safe used cars in Tanzania

- Comprehensive car insurance in Tanzania: Everything you need to know in 2025

- What’s the real cost of comprehensive car insurance in Tanzania?